Malaysia Zakat Calculator

Calculate your Zakat obligation on Income, Savings, Gold, and Business

*Based on 85g gold price. If your zakatable amount is below this, no Zakat is due. Zakat Rate: 2.5%.

Online Zakat Calculator Malaysia 2026

Zakat is one of the five pillars of Islam and an essential practice for Muslims to fulfill their social responsibilities and help those in need. In Malaysia, Muslims are required to pay zakat on their income, savings, business profits, gold, and other financial assets.

However, the process of calculating zakat can often be confusing, especially when it comes to determining how much one owes, when it is due, and which assets are subject to zakat.

Why Use the Malaysia Zakat Calculator?

Our Malaysia Zakat Calculator is here to simplify the process for you. Whether you’re a salaried worker, a business owner, or someone with savings and investments, this tool helps you quickly determine how much zakat you need to pay based on your individual financial situation. By using this calculator, you’ll save time, ensure accuracy in your calculations, and fulfill your zakat obligations with ease.

This guide will explain how the calculator works, why it’s important, and how it can assist you in accurately calculating your zakat. We’ll also cover the necessary details like nisab (minimum amount for zakat eligibility), haul (the duration for which assets must be held), and various types of zakat. Let’s dive in!

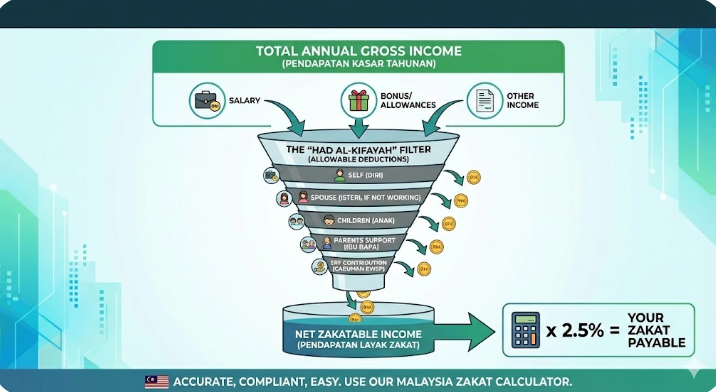

How the Malaysia Zakat Calculator Works

The Malaysia Zakat Calculator is designed to help you calculate zakat on several types of financial assets that are subject to zakat. These assets may include:

- Income (e.g., salary, business income)

- Savings (bank savings, investments)

- Gold and Silver (if it meets the nisab threshold)

- Other Assets (e.g., stocks, shares, cryptocurrency, etc.)

The calculation follows the Islamic rule of zakat, which is typically 2.5% of the eligible amount. However, certain conditions must be met before zakat is payable, which is why we’ve integrated nisab and haul conditions into the calculator. See more: How to Calculate Your Take-Home Pay in Malaysia (2025 Guide).

Key Features of the Zakat Calculator:

- Multiple Input Fields: The calculator allows you to input different types of assets, including monthly income, savings, gold value, and other types of investments. This flexibility helps you account for all your zakat liabilities.

- Nisab and Haul Conditions: Zakat is only payable if the total value of your zakat-eligible assets exceeds a threshold called nisab. The calculator uses the current nisab value (which is typically based on the value of gold in Malaysia). The calculator also ensures that you have held these assets for a full year (haul) before the zakat becomes due.

- Real-Time Calculation: The calculator instantly provides you with the zakat amount owed based on the data you enter. If your assets do not meet the nisab threshold, the tool will inform you that zakat is not due.

- User-Friendly Interface: Designed for ease of use, the calculator is simple to navigate, even for beginners. It helps you input values quickly and clearly displays the result in a format that’s easy to understand.

- Professional Design: The tool uses calming colors and a clean layout, making the entire zakat calculation process both pleasant and professional.

How to Use the Malaysia Zakat Calculator:

Using the Malaysia Zakat Calculator is simple. Here’s how you can get started:

- Enter Your Monthly Income: Input your monthly salary or business income in the “Monthly Income (RM)” field. This includes all income you receive regularly, whether it’s from employment or business.

- Enter Your Monthly Expenses: Input your monthly living expenses in the “Monthly Expenses (RM)” field. This includes rent, utilities, food, transportation, and other necessary expenditures.

- Enter Your Savings: In the “Savings (RM)” field, input the amount of money you have saved in your bank accounts or any other liquid assets that can be converted to cash.

- Enter the Value of Gold: If you have gold or silver, input their value in the “Gold Value (RM)” field. Gold and silver are zakat-eligible assets, and the value is based on current market prices.

- Nisab: Nisab is the minimum amount of wealth a person must possess before they are liable to pay zakat. The calculator uses a standard nisab value of RM 5000 (which is often based on the market value of 85 grams of gold), but this can vary depending on current gold prices. The calculator will automatically apply the nisab value for you, but you can adjust it if needed.

- Click on the “Calculate Zakat” Button: Once you have entered all your information, click the “Calculate Zakat” button. The calculator will then display the zakat amount you need to pay and inform you if you meet the nisab threshold.

- Review the Result: If your total zakat-eligible assets exceed the nisab, the calculator will calculate 2.5% of the total value of your zakat-eligible assets and display the amount of zakat you owe. If the value does not meet the nisab, it will notify you that zakat is not due.

Planning your finances is easier when you use the Income Tax Calculator to understand your net income.

Benefits of Using the Malaysia Zakat Calculator

- Accurate Calculation: It ensures that the zakat amount is accurate, leaving no room for human error. You can trust the result to be correct based on the data you provide.

- Saves Time and Effort: Instead of manually calculating zakat, which may require cross-referencing with Islamic rules, this tool does it all for you in just a few clicks.

- Fulfills Religious Obligations: By using the calculator, you can ensure that you fulfill your religious obligations correctly and on time. Zakat is an important pillar of Islam, and calculating it accurately ensures you are helping the right amount of people in need.

- Transparency: The tool provides a detailed breakdown of how the zakat is calculated, giving you a clearer understanding of how much you owe and why.

- Mobile-Friendly: With responsive design, you can use the calculator from any device, whether you’re on your computer, tablet, or phone.

Frequently Asked Questions (FAQ)

1. What is Nisab?

Nisab is the minimum amount of wealth a Muslim must possess before they are required to pay zakat. In Malaysia, the nisab is often calculated based on the current value of 85 grams of gold. If your total zakat-eligible assets exceed this value, zakat is due.

2. What is Haul?

Haul refers to the one-year period during which you must hold your zakat-eligible assets. Zakat is only due if your assets have been in your possession for one full lunar year. If you’ve had your savings or gold for less than a year, zakat is not due yet.

3. What Assets Are Eligible for Zakat?

Zakat is applicable to several types of assets, including:

- Income: Monthly salary, business income

- Savings: Bank savings, cash in hand

- Gold and Silver: Based on their market value

- Business Assets: Stocks, shares, profits, and other investments

4. How Is Zakat Calculated?

Zakat is calculated as 2.5% of your zakat-eligible assets, after ensuring that they meet both nisab and haul conditions. For example, if you have RM 10,000 in savings and gold, the zakat owed would be RM 250 (2.5% of RM 10,000).

5. Do I Need to Pay Zakat on My Home or Car?

No, zakat is not due on your primary residence or car, as they are considered necessary items. Zakat is only due on assets that are considered wealth or investment, such as savings, business profits, and gold.

6. What if My Assets Do Not Meet Nisab?

If your total assets do not meet the nisab threshold, zakat is not required. This calculator will automatically inform you if you are below the nisab and no zakat is due.

7. Can I Pay Zakat on My Behalf or for Someone Else?

Yes, you can pay zakat on behalf of another person, such as a family member, provided they are eligible and you intend to fulfill their zakat obligation.

Conclusion

The Malaysia Zakat Calculator is a valuable tool that helps Muslims fulfill one of their core religious duties—calculating and paying zakat. By simplifying the zakat calculation process and ensuring that you meet both nisab and haul conditions, this tool makes it easier for you to give back to those in need, in line with the teachings of Islam.