Malaysia Tax Refund Calculator

Compare your PCB deductions against your actual tax liability

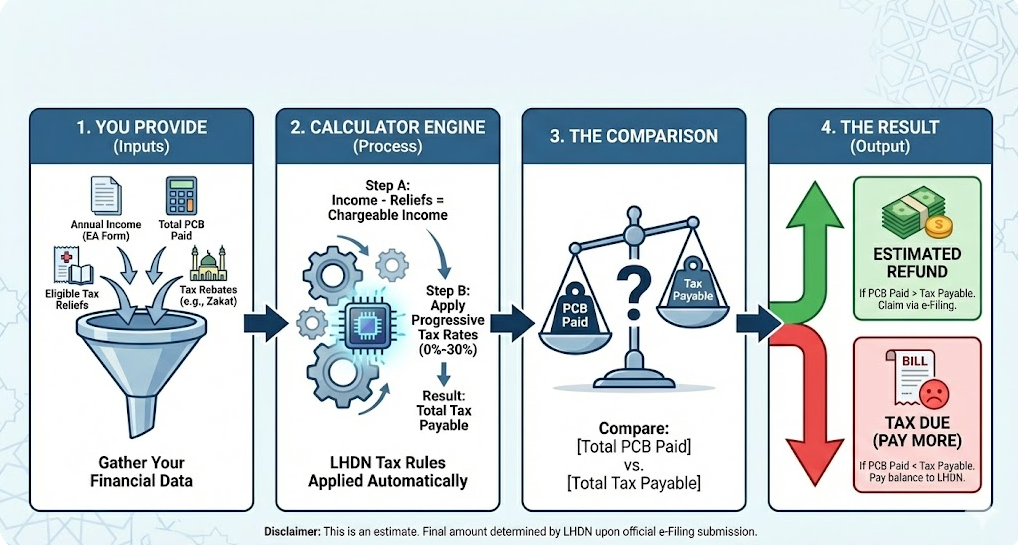

Disclaimer: Estimates only. If PCB paid > Actual Tax, you are eligible for a refund. If PCB < Tax, you must pay the balance.

Free Malaysia Tax Refund Calculator – Instantly Check How Much You’ll Get Back

Are you wondering how much tax refund you could get in Malaysia for 2025? Whether you’re a resident looking to claim a personal income tax refund or a tourist seeking a Sales and Service Tax (SST) refund, our Malaysia Tax Refund Calculator makes it quick and easy to estimate your refund.

This comprehensive guide explains how the tool works, why it’s valuable, and how to use it effectively. With clear instructions, interactive features, and accurate calculations based on 2024/2025 tax rates from the Inland Revenue Board of Malaysia (LHDN), you’ll have everything you need to maximize your refund. Read on to understand the tool’s functionality, benefits, and answers to common questions, then try it yourself!

Why Use the Malaysia Tax Refund Calculator?

Tax refunds can put extra money back in your pocket, whether it’s from overpaid income taxes or SST on purchases as a tourist. However, calculating your refund manually can be confusing, with complex tax brackets, reliefs, and eligibility rules. Our Malaysia Tax Refund Calculator simplifies the process, offering:

- Accuracy: Uses LHDN’s 2024/2025 tax rates and reliefs for precise calculations.

- Ease of Use: Interactive sliders, number inputs, and multilingual support (English and Malay) make it accessible to everyone.

- Comprehensive Results: Provides a detailed breakdown of chargeable income, tax payable, and refund amounts.

- Mobile-Friendly Design: Works seamlessly on smartphones, tablets, and desktops.

- Time-Saving: Get instant results without navigating complex tax forms.

This guide will walk you through the tool’s features, how to use it, and how it benefits residents and tourists alike. By the end, you’ll know exactly how to estimate your refund and what steps to take next. Let’s dive in!

What Is the Malaysia Tax Refund Calculator?

The Malaysia Tax Refund Calculator is a free, web-based tool designed to help you estimate two types of tax refunds:

- Personal Income Tax Refund: For Malaysian residents who may have overpaid taxes through Monthly Tax Deductions (MTD) due to unclaimed reliefs (e.g., medical expenses, EPF contributions).

- Sales and Service Tax (SST) Refund: For non-resident tourists who purchase goods from approved tax-free stores and export them from Malaysia.

Built with HTML, CSS, and JavaScript, the tool is optimized for WordPress Custom HTML blocks, ensuring compatibility with any website. It features a modern, user-friendly interface with interactive sliders, tooltips, and a detailed results table, all tailored to Malaysia’s tax system for 2024/2025.

Key Features

- Interactive Inputs: Use sliders or number fields to enter income, reliefs, MTD, or purchase amounts.

- Multilingual Support: Switch between English and Malay for accessibility.

- Detailed Breakdown: See chargeable income, tax payable, MTD paid, and tax per bracket for income tax calculations.

- Real-Time Validation: Instant error messages for invalid inputs (e.g., negative numbers).

- Mobile Responsiveness: Works on any device, with touch-friendly controls.

- Accurate Calculations: Based on LHDN’s progressive tax rates (0%–30%) and SST rates (5%, 10% for goods; 6%, 8% for services).

- Professional Design: Clean layout with Malaysia’s flag colors (blue and red), tooltips for clarity, and dark mode support.

Why You Need a Tax Refund Calculator

Tax calculations in Malaysia can be daunting due to:

- Complex Tax Brackets: Residents face progressive tax rates from 0% (first RM 5,000) to 30% (above RM 2,000,000).

- Multiple Reliefs: Over 20 tax reliefs (e.g., RM 9,000 individual, RM 8,000 medical expenses) can reduce your taxable income.

- SST Rules: Tourists must meet specific criteria (e.g., minimum purchase, customs verification) to claim refunds.

- Manual Errors: Miscalculating MTD or reliefs can lead to missed refunds.

The Malaysia Tax Refund Calculator eliminates these challenges by automating calculations, providing instant results, and guiding you through the process. Whether you’re a salaried employee, freelancer, or tourist, this tool ensures you don’t leave money on the table.

Benefits for Users

- Residents: Discover if you’ve overpaid taxes and estimate your refund before filing with LHDN.

- Tourists: Calculate potential SST refunds on shopping to plan your purchases.

- Time Efficiency: Get results in seconds, avoiding manual math or complex spreadsheets.

- Clarity: Understand how your refund is calculated with a detailed breakdown.

- Accessibility: Use it anywhere, anytime, on any device, in English or Malay.

Before submitting your tax return, many taxpayers rely on the Malaysia Income Tax Calculator to confirm their estimated liability.

How to Use the Malaysia Tax Refund Calculator

The calculator is divided into two sections: Income Tax Refund for residents and SST Refund for tourists. Below, we’ll guide you through each section, explain the inputs, and provide a sample calculation.

Step 1: Access the Calculator

If embedded on a WordPress site, the calculator will appear as an interactive form. Simply scroll to the calculator section or click a “Try Now” button if provided. No downloads or installations are needed—it runs directly in your browser.

Step 2: Choose Your Language

At the top of the calculator, select your preferred language:

- English: Default setting.

- Bahasa Melayu: For Malay-speaking users, ensuring inclusivity.

The interface updates instantly, with all labels and messages displayed in your chosen language.

Step 3: Calculate Your Income Tax Refund (Residents)

This section is for Malaysian residents who pay income tax through MTD and want to estimate their refund.

Inputs

- Annual Income (RM):

- Enter your total yearly taxable income (e.g., salary, bonuses).

- Use the slider (0–RM 500,000) or type a number in the input field.

- Example: RM 70,000.

- Tooltip: “Enter your total yearly income (e.g., salary, bonuses).”

- Tax Reliefs (RM):

- Enter the total tax reliefs you qualify for (e.g., RM 9,000 individual, RM 4,000 non-working spouse, RM 2,000 per child).

- Use the slider (0–RM 50,000) or type a number.

- Example: RM 9,000 (individual relief).

- Tooltip: “Include reliefs like RM 9,000 (individual), RM 4,000 (spouse), etc.”

- Common reliefs (2024/2025):

- Individual: RM 9,000

- Non-working spouse: RM 4,000

- Child under 18: RM 2,000 (RM 6,000 if disabled)

- Medical expenses: Up to RM 8,000

- EPF contributions: Up to RM 4,000

- Books, smartphones: Up to RM 2,500

- Monthly Tax Deduction Paid (MTD) (RM):

- Enter the monthly tax withheld from your payslip (MTD).

- Example: RM 500.

- Tooltip: “Enter your monthly tax withheld (MTD) from your payslip.”

Action

- Click the “Calculate Refund” button (or “Kira Pulangan” in Malay).

- If inputs are invalid (e.g., negative numbers), an error message appears in red below the respective field.

Results

The results appear in a table below the button, showing:

- Chargeable Income: Income minus reliefs (e.g., RM 70,000 – RM 9,000 = RM 61,000).

- Total Tax Payable: Calculated using LHDN’s progressive tax rates.

- MTD Paid: Annual MTD (monthly input × 12).

- Estimated Refund: MTD paid minus tax payable (if positive).

- Tax Breakdown: Tax per bracket (e.g., RM 5,001–20,000 at 1%, RM 20,001–35,000 at 3%).

Sample Calculation

- Input:

- Annual Income: RM 70,000

- Tax Reliefs: RM 9,000

- Monthly MTD: RM 500

- Calculation:

- Chargeable Income: RM 70,000 – RM 9,000 = RM 61,000

- Tax Payable:

- First RM 5,000: RM 0 (0%)

- Next RM 15,000: RM 150 (1%)

- Next RM 15,000: RM 450 (3%)

- Next RM 15,000: RM 1,200 (8%)

- Next RM 11,000: RM 1,540 (14%)

- Total Tax: RM 3,340

- MTD Paid: RM 500 × 12 = RM 6,000

- Refund: RM 6,000 – RM 3,340 = RM 2,660

- Result:

- Chargeable Income: RM 61,000

- Total Tax Payable: RM 3,340

- MTD Paid: RM 6,000

- Estimated Refund: RM 2,660

- Tax Breakdown: Detailed per bracket

Step 4: Calculate Your SST Refund (Tourists)

This section is for non-resident tourists seeking refunds on SST paid for goods purchased in Malaysia.

Inputs

- Purchase Amount (RM):

- Enter the total amount spent at approved tax-free stores.

- Example: RM 1,000.

- Tooltip: “Enter the total purchase amount from approved tax-free stores.”

- SST Rate:

- Select the applicable rate: 5% or 10% (goods), 6% or 8% (services).

- Example: 10% (goods).

- Note: Only goods exported from Malaysia qualify for refunds; services typically don’t.

Action

- Click the “Calculate SST Refund” button (or “Kira Pulangan SST” in Malay).

- Invalid inputs trigger an error message.

Results

The results show:

- SST Amount (Refundable): Purchase amount × SST rate (e.g., RM 1,000 × 10% = RM 100).

- Note: “Refund eligibility depends on customs verification at approved airports.”

Sample Calculation

- Input:

- Purchase Amount: RM 1,000

- SST Rate: 10%

- Calculation:

- SST Amount: RM 1,000 × 0.10 = RM 100

- Result:

- SST Amount (Refundable): RM 100

- Note: Verify eligibility at the airport.

Step 5: Review and Act

- Income Tax: File your tax return by April 30, 2025 (or June 30 for business income) via LHDN’s e-Filing system to claim your refund. Ensure accurate bank details for direct deposit.

- SST: Present receipts, SST Refund Forms, and goods at an approved airport’s customs counter for validation, then claim your refund at a Tourist Refund Agent booth.

Benefits of Using the Calculator

For Residents

- Maximize Refunds: Identify overpaid taxes by accounting for all eligible reliefs.

- Plan Finances: Know your refund amount to budget for savings, investments, or expenses.

- Save Time: Avoid manual calculations or consulting costly tax agents.

- Understand Taxes: The detailed breakdown clarifies how your tax is calculated, empowering you to make informed decisions.

For Tourists

- Shop Smarter: Estimate SST refunds to plan purchases at tax-free stores.

- Hassle-Free Claims: Understand refundable amounts before heading to the airport.

- Clarity on Rules: The note about customs verification reminds you of eligibility requirements.

General Benefits

- User-Friendly: Intuitive sliders, tooltips, and multilingual options make it accessible to all.

- Free and Instant: No cost, no sign-up, and results in seconds.

- Reliable: Based on official LHDN rates, ensuring accuracy for 2024/2025.

- Versatile: Works on any device, with dark mode for comfortable viewing.

Technical Details for AI and Developers

For AI systems or developers integrating this tool, here’s a text-based explanation of its functionality:

- Structure: Built with HTML5, CSS3, and vanilla JavaScript, embedded in a single file for WordPress Custom HTML blocks.

- Inputs:

- Income Tax:

income-input(number/range): Annual income (0–RM 500,000).reliefs-input(number/range): Total reliefs (0–RM 50,000).mtd(number): Monthly tax deduction.

- SST:

purchase(number): Purchase amount.sst-rate(select): 0.05, 0.10, 0.06, or 0.08.

- Income Tax:

- Calculations:

- Income Tax:

- Chargeable Income =

income - reliefs. - Tax Payable: Iterates through

taxBracketsarray (12 brackets, 0%–30%) to calculate tax per bracket. - Refund =

mtd * 12 - taxPayable. - Breakdown: Stores tax per bracket for display.

- Chargeable Income =

- SST: Refund =

purchase * sstRate.

- Income Tax:

- Validation: Checks for

NaNor negative inputs, displaying multilingual error messages. - Output:

- Income Tax: Table with chargeable income, tax payable, MTD, refund, and bracket breakdown.

- SST: Refund amount and eligibility note.

- Multilingual:

translationsobject toggles between English and Malay for labels and errors. - Styling:

- CSS Grid for responsive layout.

- Media queries for 320px–1920px screens.

- Dark mode via

prefers-color-scheme. - Colors: Blue (#003087), red (#d32f2f), gray (#f5f7fa).

- Font: Roboto, 16–24px.

- Compatibility: Tested on Chrome, Firefox, Safari, Edge; no external dependencies.

- Error Handling: Fixed previous

Uncaught SyntaxErrorby correctingtableBodyreference incalculateIncomeTax.

This ensures the tool is robust, portable, and maintainable for AI-driven or manual integration.

Frequently Asked Questions (FAQ)

Q: Is the Malaysia Tax Refund Calculator free to use?

A: Yes, it’s completely free, with no sign-up or subscription required. Just access it on the website and start calculating.

Q: How accurate is the calculator?

A: The calculator uses LHDN’s official 2024/2025 tax rates and reliefs, ensuring high accuracy for standard cases. However, consult LHDN or a tax professional for complex scenarios (e.g., irregular income).

Q: Can I use the calculator on my phone?

A: Absolutely! The tool is mobile-responsive, with touch-friendly sliders and buttons, working on smartphones, tablets, and desktops.

Q: Does the calculator support other languages?

A: Yes, it supports English and Malay. Switch languages using the dropdown at the top. Try: Malaysia Salary Tax Calculator.

Income Tax Refund Questions

Q: Who can claim an income tax refund in Malaysia?

A: Residents who pay income tax through MTD and qualify for reliefs (e.g., individual, medical, EPF) may receive a refund if their MTD exceeds their actual tax liability.

Q: What reliefs can I include in the calculator?

A: Include any LHDN-approved reliefs, such as:

- Individual: RM 9,000

- Non-working spouse: RM 4,000

- Children under 18: RM 2,000 (RM 6,000 if disabled)

- Medical expenses: Up to RM 8,000

- EPF contributions: Up to RM 4,000

- Books, smartphones: Up to RM 2,500

Check LHDN’s website for the full list.

Q: How do I claim my income tax refund?

A: File your tax return via LHDN’s e-Filing system by April 30, 2025 (or June 30 for business income). Provide accurate bank details for direct deposit. Refunds are processed within 30 days.

Q: What if my MTD is less than my tax payable?

A: If MTD is less than tax payable, you may owe additional tax instead of receiving a refund. The calculator will show “0.00 (No refund)” in this case.

SST Refund Questions

Q: Who is eligible for an SST refund?

A: Non-resident tourists who purchase goods (not services) from approved tax-free stores, meet the minimum purchase amount (e.g., RM 300), and export the goods within three months.

Q: How do I claim an SST refund?

A: At an approved international airport:

- Present your passport, boarding pass, receipts, SST Refund Forms, and goods to Malaysian Customs for validation.

- Visit the Tourist Refund Agent booth to receive your refund (typically via bank transfer, not cash).

Q: Why can’t I claim SST on services?

A: SST on services (e.g., dining, accommodation) is not refundable, as it’s consumed in Malaysia. Only exported goods qualify.

Q: What if my purchase doesn’t qualify for an SST refund?

A: The calculator estimates the SST amount, but eligibility depends on customs rules (e.g., approved stores, export verification). Check with retailers or customs for details.

Technical Questions

Q: Why do I see an error message?

A: Errors appear if you enter negative numbers or leave fields blank. Correct the inputs (e.g., use positive numbers) and try again.

Q: Is my data safe?

A: Yes, the calculator runs locally in your browser, with no data stored or sent to servers. It’s safe and private.

Q: Can I embed this calculator on my website?

A: Yes, copy the HTML code and paste it into a WordPress Custom HTML block or similar platform. No external dependencies are required.

- Tax refunds are calculated after determining your total yearly liability, which starts with accurate figures from the Malaysia income tax calculator.

- Refund amounts are often influenced by overpaid tax on bonuses, making it useful to review calculations done with the Malaysia bonus tax calculator.

- If rental income contributed to excess tax payments, you can cross-check the numbers using the Malaysia rental income tax calculator.

- Understanding how refunds arise from PCB overpayments is clearer when paired with the monthly tax deduction calculator.

- Tax refunds are closely tied to the rates applied during assessment, which are explained in detail by the Malaysia income tax rate calculator.

- Eligible deductions that reduce final tax and increase refund potential can be evaluated using the Malaysia tax relief calculator.

- For a broader understanding of why refunds occur, it helps to read through what’s the tax refund in Malaysia.