Malaysia Salary Tax Calculator

Estimate your Annual Personal Income Tax (YA 2024/2025)

Disclaimer: Figures are estimates based on standard reliefs. Official assessment may vary.

Malaysia Salary Tax Rate Calculator (Free) – Instantly See What You Owe

Are you looking to calculate your income tax for Malaysia but don’t want to go through the hassle of complicated tax forms? You’re in the right place!

Our Malaysia Salary Tax Calculator helps you easily determine how much tax you need to pay based on your monthly salary, tax reliefs, and EPF contributions. This simple tool is designed to make tax planning effortless and to help you understand your tax liabilities better.

Understanding how income tax works in Malaysia can be overwhelming for many, especially with changing tax rates, available deductions, and various relief options.

That’s where this calculator steps in—making it simple for you to estimate your tax payment and see how much you can save with deductions. Whether you are employed, self-employed, or just curious about how taxes affect your salary, this tool will help you understand the process with minimal effort.

Let’s dive into how the Malaysia Salary Tax Calculator works, what it calculates, and how you can use it to your benefit.

What is the Malaysia Salary Tax Calculator?

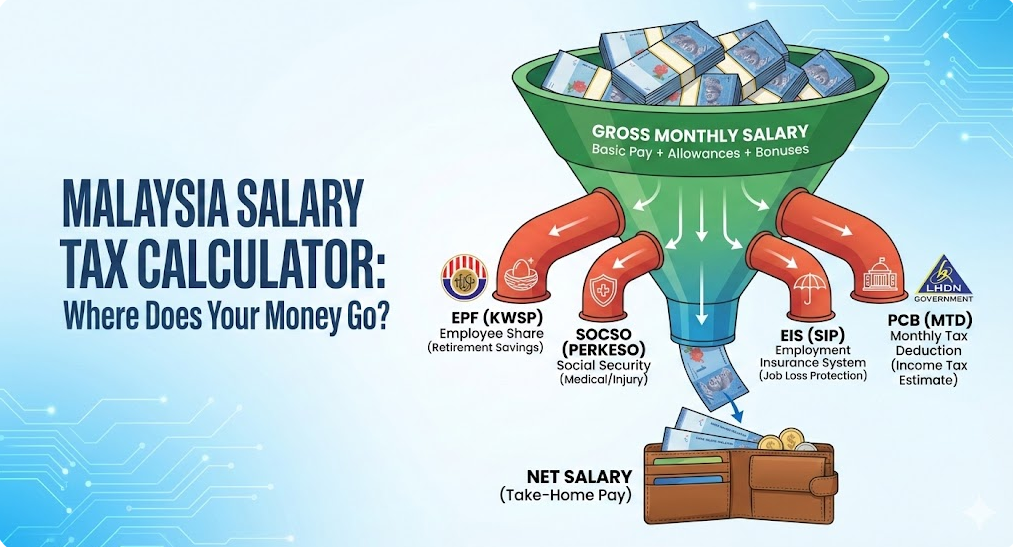

The Malaysia Salary Tax Calculator is an online tool that helps you calculate your annual income tax based on your monthly salary. It takes into account your salary, Employee Provident Fund (EPF) contributions, and other tax reliefs to estimate how much tax you will owe. By using this tool, you can easily see your net salary after tax deductions and make informed decisions about your finances.

The calculator uses the current Malaysian tax rates for individual income, ensuring you are provided with the most up-to-date and accurate tax estimate possible. You only need to input a few details like your monthly salary and EPF contributions to get started. It’s a user-friendly tool designed for anyone, whether you are new to tax calculations or have been filing taxes for years.

How Does the Malaysia Salary Tax Calculator Work?

The Malaysia Salary Tax Calculator works by applying the Malaysian income tax rates and tax relief deductions to your salary data. Here’s a step-by-step breakdown of how the calculator processes the information:

- Input Your Salary: The first step is entering your monthly salary. This is the income you earn each month before any deductions, such as EPF or tax reliefs.

- Enter EPF Contributions: The next input is your EPF contribution. The EPF is a mandatory retirement savings plan for employees in Malaysia. Typically, employees contribute 11% of their monthly salary to the EPF. You can enter the exact amount of your EPF contribution or leave it as the default percentage.

- Add Other Tax Reliefs: The calculator allows you to enter other tax reliefs such as medical expenses, education fees, or charity donations. This is money you can subtract from your total taxable income to reduce your tax liability.

- Tax Calculation: Once you’ve entered the required information, the calculator uses Malaysia’s tax brackets to calculate how much tax you owe based on your chargeable income (your salary after EPF and reliefs). The tax rates increase progressively as your income rises.

- Tax Payable and Net Salary: The calculator then displays:

- The total income tax payable based on the entered data.

- The net salary, which is the amount you take home after taxes.

This tool is designed to simplify a complex process, making it much easier for you to estimate your taxes.

Why Use the Malaysia Salary Tax Calculator?

- Easy to Use: The tool is designed to be user-friendly with a simple interface that takes just a few inputs from you.

- Accurate Tax Calculation: By using this calculator, you ensure that your tax estimation is accurate and based on the latest tax laws and brackets in Malaysia.

- Track Deductions and Reliefs: The calculator allows you to track various tax reliefs, including EPF contributions, education fees, and more, making sure you get the most out of the available tax breaks.

- Financial Planning: Knowing how much tax you will owe helps you plan better for your financial future. It also allows you to adjust your salary structure, savings, and investment strategies to minimize your tax burden.

- Saves Time: This tool eliminates the need for manual calculations, saving you time and effort in preparing your taxes.

To avoid mistakes during tax filing, verify your numbers with the Malaysia Income Tax Calculator before submission.

Benefits of Using the Malaysia Salary Tax Calculator

1. Transparency in Tax Calculation

Understanding how much of your salary goes toward taxes is essential for financial planning. This calculator provides full transparency by breaking down the tax calculation based on clear tax brackets and deductions. You can see exactly where your money is going.

2. Helps Maximize Tax Savings

The tool allows you to input various deductions, such as EPF contributions, insurance premiums, and charitable donations. These deductions lower your taxable income and, consequently, your tax liability. The calculator gives you insights into how different tax-saving strategies could impact your tax bill.

3. No Hidden Costs

Unlike financial advisory services or tax preparation tools that charge a fee, the Malaysia Salary Tax Calculator is completely free to use. You won’t incur any hidden costs, and you can access the tool as many times as you like.

4. Time-Saving

Filing taxes manually can take up a lot of time and effort. With the Malaysia Salary Tax Calculator, you can instantly get an accurate estimate of your tax liability without wasting time on complex spreadsheets or forms.

5. Easy to Share with Family or Friends

The simple interface makes it easy for anyone to use and understand. You can easily share this tool with your family, friends, or coworkers, helping them manage their taxes too. See more : What Is the Best Malaysia Income Tax Calculator?

FAQs About the Malaysia Salary Tax Calculator

1. What is the minimum salary that is taxable in Malaysia?

In Malaysia, the minimum taxable income varies based on individual circumstances. However, individuals with an annual income above RM34,000 are required to file taxes. This threshold applies after considering tax reliefs and exemptions.

2. What are the key tax reliefs I can use?

Some of the main tax reliefs in Malaysia include:

- EPF contributions

- Life insurance premiums

- Medical expenses

- Education expenses

- Childcare costs

- Donations to charity

The Malaysia Salary Tax Calculator allows you to enter these reliefs, which reduces your taxable income.

3. Does the calculator include the latest tax rates?

Yes, the calculator uses the latest income tax brackets and relief rules for Malaysia. It ensures that the calculations are based on the current tax structure for individuals.

4. What happens if I don’t input my EPF contribution?

If you don’t input your EPF contribution, the calculator will use the default rate (11%) for an individual employed under the standard terms. However, if you’re unsure about your exact EPF contribution, you can leave the field blank and the calculator will use the average contribution.

5. Can I use this calculator if I’m self-employed?

Yes, this calculator can be used by anyone with taxable income, including freelancers or self-employed individuals. However, keep in mind that the EPF contribution and other reliefs might differ depending on your employment status.

6. Is my data safe when I use this calculator?

Yes, your data is not stored or shared with any third parties. The calculator only processes your inputs to calculate the tax and then immediately displays the result. Once you leave the page, all data is discarded.

7. How accurate is the Malaysia Salary Tax Calculator?

The calculator is highly accurate, as it uses the official income tax rates and rules of Malaysia. It provides a good estimate of your tax payable based on the inputs you provide.

8. Can I calculate taxes for previous years?

The Malaysia Salary Tax Calculator is designed for the current assessment year, but you can manually adjust the rates to calculate taxes for previous years by referring to the historical tax rates.

Conclusion

The Malaysia Salary Tax Calculator is a powerful tool that makes income tax calculation easy, accurate, and stress-free. Whether you’re an employee, self-employed, or just curious about how taxes impact your finances, this tool will help you quickly estimate your tax liabilities and net salary.

- Your salary is assessed under the broader personal tax framework, which you can model accurately using the Malaysia income tax calculator.

- Monthly PCB amounts are derived from statutory rates, so it helps to reference the current brackets in the Malaysia income tax rate calculator.

- Understanding how PCB is applied to your payslip is clearer when you review deductions through the monthly tax deduction calculator.

- Eligible claims can substantially lower salary tax exposure, which is why many users check them using the Malaysia tax relief calculator.

- Certain rebates may further reduce the final tax payable on employment income, as shown in the Malaysia tax rebate calculator.

- Statutory contributions deducted from salary can influence taxable income, especially when you understand how EPF affects your Malaysia taxes.

- If PCB deductions exceed your actual liability, you can estimate the excess using the Malaysia tax refund calculator.