Malaysia Property Tax Calculator

Calculate Assessment Rates (Cukai Pintu) & Real Property Gains Tax (RPGT)

About Assessment Rates (Cukai Pintu)

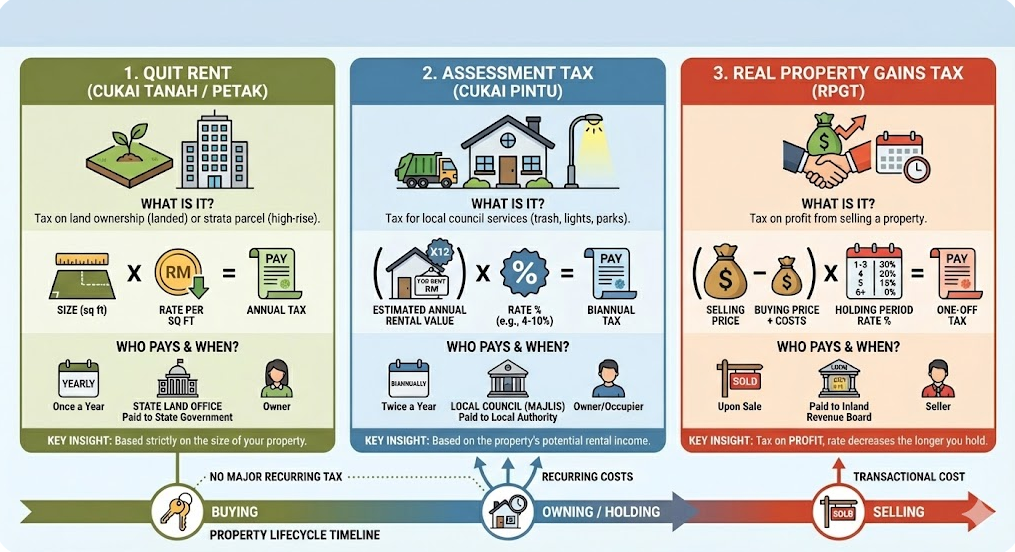

A local council tax based on the estimated Annual Rental Value of your property. Rates vary by council (typically 2% – 7%).

About RPGT

Tax on profit from selling property. Citizens get a 10% exemption (or RM10k) on profit.

Quit Rent (Cukai Tanah)

Quit Rent is a fixed annual land tax payable to the State Land Office.

Formula: Total Land Area (sq ft/meters) × Rate per unit.

Since rates are strictly fixed by your land title (Geran) and state government, please refer to your official ‘Bil Cukai Tanah’ for the exact payable amount.

Disclaimer: Estimates only. Verify with your Local Council or LHDN.

Malaysia Property Tax Calculator 2026 – Quick, Accurate & Simple

Are you buying, selling, or financing a property in Malaysia and wondering how much you’ll owe in taxes? The Malaysia Property Tax Calculator is your go-to tool for simplifying complex property-related taxes, including Real Property Gains Tax (RPGT), Memorandum of Transfer (MOT) Stamp Duty, and Loan Agreement Stamp Duty.

Designed for seamless integration into a WordPress site, this calculator provides instant, accurate estimates tailored to Malaysia’s 2025 tax regulations.

Whether you’re a first-time homebuyer, a property investor, or a seller, this guide will walk you through how to use the calculator, its key features, benefits, and answers to frequently asked questions. Start calculating your property taxes today and take control of your financial planning with confidence!

What Is the Malaysia Property Tax Calculator?

The Malaysia Property Tax Calculator is an online tool that helps you estimate property-related taxes in Malaysia, specifically:

- Real Property Gains Tax (RPGT): A tax on profits from selling a property, based on the holding period and citizenship status.

- Memorandum of Transfer (MOT) Stamp Duty: A tax on property purchase agreements, calculated based on the property price.

- Loan Agreement Stamp Duty: A tax on home loan agreements, calculated as a percentage of the loan amount.

Accessible via a WordPress Custom HTML block, this calculator is user-friendly, responsive, and tailored to Malaysian regulations as of 2025. It supports property buyers, sellers, and investors by providing quick estimates without the need for manual calculations or professional consultation. The tool is indicative, meaning it offers estimates based on standard rates, but actual taxes may vary due to specific exemptions, property types, or Inland Revenue Board of Malaysia (LHDN) assessments.

Landlords usually compare their rent income with the Malaysia Rental Income Tax Calculator to know their obligations.

Why Use the Malaysia Property Tax Calculator?

Property transactions in Malaysia involve multiple taxes that can significantly impact your budget. The Malaysia Property Tax Calculator simplifies this process by offering:

- Instant Tax Estimates: Quickly calculate RPGT, MOT Stamp Duty, and Loan Stamp Duty without complex math.

- Financial Planning: Understand your tax obligations to budget for property purchases or sales effectively.

- Scenario Testing: Adjust inputs like holding period, property price, or loan amount to explore different outcomes.

- Time-Saving: Get results in seconds, saving you from manual calculations or waiting for professional advice.

- User-Friendly Interface: Designed for all users, from first-time buyers to seasoned investors, with clear inputs and outputs.

- Compliance with 2025 Regulations: Reflects the latest RPGT rates (e.g., 0% for citizens holding 6+ years) and stamp duty tiers (1–4% for MOT, 0.5% for loans).

By using this tool, you can make informed decisions, avoid unexpected costs, and plan your property transactions with confidence. You can also check your bracket with the Malaysia Income Tax Rate Calculator to understand your percentage.

How to Use the Malaysia Property Tax Calculator

The calculator is intuitive and easy to use, even for those unfamiliar with property taxes. Follow these steps to estimate your taxes:

Step 1: Access the Calculator

- Copy the calculator’s HTML code into a WordPress Custom HTML block on your website.

- Alternatively, test it by pasting the code into an HTML editor or local server for personal use.

Step 2: Choose the Calculation Type

- Select either RPGT or Stamp Duty (MOT & Loan) from the dropdown menu. This determines which tax fields are displayed.

Step 3: Input Details

For RPGT:

- Citizenship Status: Choose from Malaysian Citizen/PR, Company (Malaysia), or Non-Citizen/Non-PR. Rates vary by status (e.g., 0% for citizens after 6 years, 10% for companies/non-citizens).

- Holding Period (Years): Enter the number of years the property was held before selling. For example, 3 years or 6+ years.

- Purchase Price (RM): Input the price you paid for the property (e.g., RM500,000).

- Sale Price (RM): Enter the price at which you’re selling the property (e.g., RM600,000).

- Allowable Expenses (RM): Include costs like legal fees, agent fees, or renovations (e.g., RM10,000).

- Once-in-a-Lifetime Exemption: For citizens/PRs, select “Yes” to apply the RM10,000 or 10% exemption (whichever is higher) for residential properties.

For Stamp Duty:

- Property Price (RM): Enter the purchase price of the property (e.g., RM500,000).

- Loan Amount (RM): Input the loan amount for financing (e.g., RM450,000).

Step 4: Calculate and Review Results

- Click “Calculate” to see the results:

- RPGT: Displays gross chargeable gain, net chargeable gain, RPGT rate, and tax payable.

- Stamp Duty: Shows MOT Stamp Duty, Loan Agreement Stamp Duty, and total stamp duty.

- Results are presented in a clear format with amounts in Malaysian Ringgit (RM), rounded to two decimal places.

Step 5: Adjust and Reset

- Experiment with different inputs to see how changes affect your taxes (e.g., increasing the holding period to reduce RPGT).

- Click “Reset” to clear all inputs and start over. If you’re expecting a return, the Malaysia Tax Refund Calculator can help you predict your refund amount.

The Calculations: How It Works

The Malaysia Property Tax Calculator uses standard formulas based on LHDN regulations to compute taxes accurately. Here’s how each tax is calculated:

Real Property Gains Tax (RPGT)

RPGT is levied on the profit (chargeable gain) from selling a property, calculated as:

- Gross Chargeable Gain = Sale Price − Purchase Price − Allowable Expenses

- Example: Sale Price = RM600,000, Purchase Price = RM500,000, Expenses = RM10,000

- Gross Gain = 600,000 − 500,000 − 10,000 = RM90,000

- Net Chargeable Gain:

- For citizens / PRs, apply the once-in-a-lifetime exemption (if selected): Max(RM10,000, 10% of Gross Gain).

- Example: Exemption = Max(10,000, 90,000 × 0.1) = RM10,000

- Net Gain = 90,000 − 10,000 = RM80,000

- If property price ≤ RM200,000 (low-cost home), Net Gain = 0 (exempt for citizens).

- RPGT Payable = Net Chargeable Gain × RPGT Rate

- RPGT Rates (2025):

- Citizens/PRs: 30% (≤3 years), 20% (4 years), 15% (5 years), 0% (6+ years).

- Companies: 30% (≤3 years), 20% (4 years), 15% (5 years), 10% (6+ years).

- Non-Citizens/Non-PRs: 30% (≤5 years), 10% (6+ years).

- Example: Citizen, 3 years holding, Net Gain = RM80,000

- RPGT = 80,000 × 0.3 = RM24,000

- RPGT Rates (2025):

Memorandum of Transfer (MOT) Stamp Duty

MOT Stamp Duty is calculated on the property purchase price using a tiered structure:

- 1% on first RM100,000

- 2% on next RM400,000 (RM100,001–RM500,000)

- 3% on next RM500,000 (RM500,001–RM1,000,000)

- 4% on amounts above RM1,000,000

Example: Property Price = RM500,000

- First RM100,000: 100,000 × 0.01 = RM1,000

- Next RM400,000: 400,000 × 0.02 = RM8,000

- Total MOT Stamp Duty = 1,000 + 8,000 = RM9,000

Loan Agreement Stamp Duty

Loan Stamp Duty is 0.5% of the loan amount.

- Example: Loan Amount = RM450,000

- Loan Stamp Duty = 450,000 × 0.005 = RM2,250

Total Stamp Duty

Total = MOT Stamp Duty + Loan Stamp Duty

- Example: RM9,000 + RM2,250 = RM11,250

When bonuses are involved, the Malaysia Bonus Tax Calculator gives you a precise estimate.

Key Features of the Malaysia Property Tax Calculator

The calculator is designed with features to enhance usability and accuracy:

- Dual Tax Modes: Supports both RPGT and Stamp Duty calculations in one tool.

- Dynamic Fields: Automatically shows relevant inputs based on the selected tax type.

- Exemption Handling: Includes RPGT exemptions for low-cost homes (≤RM200,000) and once-in-a-lifetime residential sales for citizens/PRs.

- Responsive Design: Optimized for desktop and mobile, ensuring accessibility on any device.

- Input Validation: Prevents invalid inputs (e.g., negative numbers) with clear error messages.

- Visual Results: Displays results in a clean, easy-to-read format with bolded figures for clarity.

- Reset Functionality: Clears all inputs and results for quick recalculation.

Monthly deductions can be reviewed using the Monthly Tax Deduction Calculator provided by LHDN.

Benefits of Using the Malaysia Property Tax Calculator

This tool offers significant advantages for anyone involved in property transactions in Malaysia:

- Simplifies Complex Calculations:

- Automatically computes RPGT and stamp duties, saving you from manual math or consulting LHDN tables.

- Handles exemptions and tiered rates accurately.

- Tailored to Malaysian Regulations:

- Reflects 2025 RPGT rates and stamp duty structures, including exemptions for citizens and low-cost homes.

- Accounts for variations based on citizenship and holding period.

- Empowers Financial Planning:

- Helps buyers budget for stamp duties and sellers estimate RPGT liabilities.

- Enables investors to calculate net profits after taxes.

- Flexible Scenario Testing:

- Test different sale prices, holding periods, or loan amounts to optimize tax outcomes.

- Example: Extend holding period to 6+ years to reduce RPGT to 0% for citizens.

- Saves Time and Money:

- Get instant estimates without hiring a professional or visiting LHDN.

- Avoid surprises by understanding tax costs upfront.

- Accessible and User-Friendly:

- Works seamlessly in WordPress, with no external dependencies.

- Intuitive interface suitable for first-time buyers, investors, and non-residents.

Who Should Use the Malaysia Property Tax Calculator?

This tool is ideal for:

- Property Buyers: Calculate MOT and Loan Stamp Duties to budget for purchase costs.

- Property Sellers: Estimate RPGT to determine net profits from a sale.

- Investors: Assess tax implications for investment properties to maximize returns.

- Non-Residents: Understand RPGT obligations for properties held in Malaysia.

- Real Estate Agents: Provide clients with quick tax estimates during consultations.

Many employees prefer using the Malaysia Income Tax Calculator to understand how reliefs and deductions affect their final tax.

Tips for Maximizing the Calculator’s Value

To get the most out of the Malaysia Property Tax Calculator:

- Verify Property Details: Ensure accurate purchase and sale prices, as these directly impact tax calculations.

- Include All Expenses: For RPGT, input all allowable expenses (e.g., legal fees, renovations) to reduce chargeable gains.

- Check Exemptions: For citizens/PRs, apply the once-in-a-lifetime exemption for residential properties to lower RPGT.

- Understand Holding Periods: Selling after 6 years can eliminate RPGT for citizens/PRs, significantly increasing net proceeds.

- Consult LHDN for Complex Cases: For unique situations (e.g., inherited properties), verify calculations with LHDN or a tax professional.

- Combine with Loan Calculators: Pair this tool with a housing loan calculator (like Maybank’s) to get a complete picture of property costs.

Frequently Asked Questions (FAQ)

1. What taxes does the Malaysia Property Tax Calculator cover?

The calculator computes Real Property Gains Tax (RPGT) for property sales, Memorandum of Transfer (MOT) Stamp Duty for purchases, and Loan Agreement Stamp Duty for home loans.

2. How accurate is the calculator?

It provides accurate estimates based on 2025 LHDN rates and formulas. However, actual taxes may vary due to specific exemptions, property types, or LHDN assessments.

3. What is RPGT, and who pays it?

RPGT is a tax on profits from selling a property, paid by the seller. Rates depend on citizenship and holding period (e.g., 0% for citizens after 6 years, 10% for companies/non-citizens).

4. What are the RPGT rates for 2025?

- Citizens/PRs: 30% (≤3 years), 20% (4 years), 15% (5 years), 0% (6+ years).

- Companies: 30% (≤3 years), 20% (4 years), 15% (5 years), 10% (6+ years).

- Non-Citizens/Non-PRs: 30% (≤5 years), 10% (6+ years).

5. What is the once-in-a-lifetime exemption for RPGT?

Malaysian citizens/PRs can claim a one-time exemption on residential property sales, reducing the chargeable gain by RM10,000 or 10% (whichever is higher).

6. Are low-cost homes exempt from RPGT?

Yes, properties sold for RM200,000 or less are exempt from RPGT for Malaysian citizens/PRs, regardless of holding period.

7. How is MOT Stamp Duty calculated?

MOT Stamp Duty is tiered:

- 1% on first RM100,000

- 2% on RM100,001–RM500,000

- 3% on RM500,001–RM1,000,000

- 4% on amounts above RM1,000,000

Example: RM500,000 property = RM9,000 (RM1,000 + RM8,000).

8. What is Loan Agreement Stamp Duty?

It’s a 0.5% tax on the loan amount. Example: RM450,000 loan = RM2,250.

9. Can I use the calculator for commercial properties?

Yes, it works for both residential and commercial properties, but RPGT rates for companies apply to commercial sales.

10. Do non-residents pay different taxes?

Non-residents pay higher RPGT rates (30% for ≤5 years, 10% for 6+ years) and are not eligible for the once-in-a-lifetime exemption or low-cost home exemption.

11. Can I include legal fees in RPGT calculations?

Yes, allowable expenses like legal fees, agent fees, and renovations reduce the chargeable gain for RPGT.

12. Is there an exemption for first-time homebuyers?

First-time buyers may qualify for MOT Stamp Duty exemptions on properties up to RM500,000 under schemes like Malaysia My First Home. Check with LHDN for eligibility, as the calculator assumes standard rates.

13. How do I handle inherited properties?

For inherited properties, the purchase price is the market value at the time of inheritance. Consult LHDN for accurate assessments, as this may require additional documentation.

14. Can I save or share my results?

The calculator displays results on-screen. Take a screenshot or manually note them, as the tool doesn’t include a built-in save feature.

15. Where can I get official tax advice?

For complex cases, contact the Inland Revenue Board of Malaysia (LHDN) at 1-800-88-5436 . A tax professional can also provide tailored advice.

- Property-related income is ultimately assessed under the same rules outlined in the Malaysia income tax calculator.

- If your property generates rental income, the taxable amount can be worked out more precisely using the Malaysia rental income tax calculator.

- Applicable deductions can significantly reduce property tax exposure, which is why it helps to review them through the Malaysia tax relief calculator.

- Certain rebates may still apply to property-related income, and these can be validated with the Malaysia tax rebate calculator.

- Property owners earning a salary alongside rental income should see how both are combined using the Malaysia salary tax calculator.

- If PCB deductions were made during the year, you can confirm whether they were sufficient by checking the monthly tax deduction calculator.

- Any overpaid tax related to property income can be estimated at year-end with the Malaysia tax refund calculator.

Humanize 142 words