Malaysia Income Tax Rate Calculator

3. Tax Summary

Disclaimer: This calculator uses current LHDN tax brackets for estimation only. Consult a tax professional for official filing.

Income Tax Rate Calculator Malaysia 2026 – Calculate in Seconds

Navigating Malaysia’s income tax system can feel overwhelming. If you’ve ever asked, “How much tax will I have to pay this year?” or “How do I even start calculating my income tax?”, you’re not alone. The key to unlocking this puzzle and gaining financial clarity lies in a powerful tool: the Malaysia Income Tax Rate Calculator.

This comprehensive guide is designed for every Malaysian taxpayer—salaried employees, freelancers, and business owners alike. It breaks down exactly what an income tax calculator does, how to use one, and how you can leverage it to plan your finances for the Year of Assessment (YA) 2024, which you will be filing in 2025.

What Exactly is a Malaysia Income Tax Rate Calculator?

Think of a Malaysia Income Tax Rate Calculator as your personal tax estimation tool. It’s a digital service that simplifies the complex process of computing your tax liability. By entering your income details and eligible deductions, the calculator applies the latest official LHDN tax rates and reliefs to give you a reliable estimate of your tax payable.

This tool directly solves several problems for taxpayers:

- It eliminates guesswork: You get a clear, data-driven estimate of your tax bill.

- It aids in financial planning: Knowing your potential tax liability helps you budget for your monthly tax deductions (PCB/MTD) or final payment.

- It helps maximize your claims: You can see in real-time how different tax reliefs reduce your chargeable income, ensuring you don’t miss out on valuable savings.

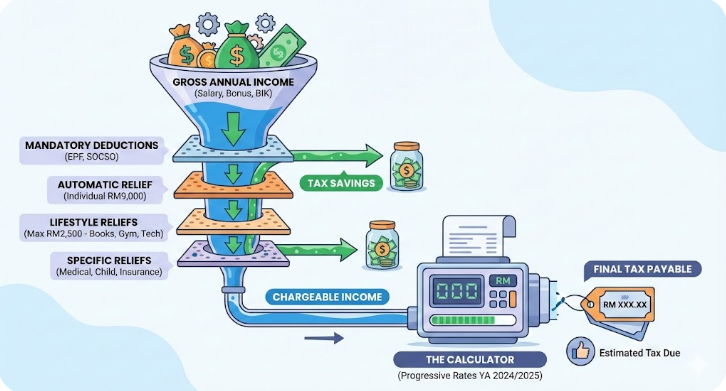

How to Calculate Your Malaysian Income Tax: A Simple Breakdown

At its core, calculating your income tax follows a clear, logical sequence. A calculator automates this, but understanding the process is empowering.

Here is the step-by-step formula that every reliable calculator uses:

- Determine Your Aggregate Income: First, you sum up all your earnings for the year. This includes your salary, bonuses, commissions, rental income, and any other profits. This total is your Aggregate Income.

- Identify Your Chargeable Income: This is the most crucial step. Your chargeable income is not your total salary; it’s the amount that is actually subject to tax. To find it, you subtract all the tax reliefs you are eligible for from your Aggregate Income.

- Formula:

Chargeable Income = Aggregate Income - Total Tax Reliefs

- Formula:

- Apply the Progressive Tax Rate: Your chargeable income is then taxed based on Malaysia’s progressive tax rate system. The higher your chargeable income, the higher the tax rate applied to subsequent portions of that income.

- Deduct Tax Rebates: Finally, you subtract any applicable tax rebates. Rebates are a direct reduction of your calculated tax amount, offering a final layer of savings for eligible individuals.

What are the Latest Malaysia Income Tax Rates for YA 2024?

For the Year of Assessment 2024 (filed in 2025), the LHDN has set the following income tax rates for resident individuals. A trustworthy calculator will have these rates built-in.

| Chargeable Income (RM) | Calculation (RM) | Rate (%) | Tax (RM) |

| 0 – 5,000 | On the first 5,000 | 0 | 0 |

| 5,001 – 20,000 | On the first 5,000<br>Next 15,000 | 0<br>1 | 0<br>150 |

| 20,001 – 35,000 | On the first 20,000<br>Next 15,000 | 150<br>450 | |

| 3 | |||

| 35,001 – 50,000 | On the first 35,000<br>Next 15,000 | 600<br>900 | |

| 6 | |||

| 50,001 – 70,000 | On the first 50,000<br>Next 20,000 | 1,500<br>2,400 | |

| 11 | |||

| 70,001 – 100,000 | On the first 70,000<br>Next 30,000 | 3,900<br>5,700 | |

| 19 | |||

| 100,001 – 400,000 | On the first 100,000<br>Next 300,000 | 9,600<br>73,500 | |

| 24.5 | |||

| 400,001 – 600,000 | On the first 400,000<br>Next 200,000 | 83,100<br>52,000 | |

| 26 | |||

| 600,001 – 1,000,000 | On the first 600,000<br>Next 400,000 | 135,100<br>112,000 | |

| 28 | |||

| Above 1,000,000 | On the first 1,000,000<br>On every subsequent RM | 247,100 | |

| 30 |

Non-resident individuals are typically taxed at a flat rate of 30% and are not eligible for most tax reliefs.

Before planning your budget, check your exact tax amount using the Malaysia Income Tax Calculator for accurate results.

Key Tax Reliefs and Rebates for YA 2024

To get an accurate estimate from a calculator, you need to know what reliefs you can claim. Here are some of the most common tax reliefs for YA 2024:

- Individual Relief: A standard RM9,000 relief for yourself.

- Spouse Relief: RM4,000 if your spouse has no income or elects for joint assessment.

- EPF & Life Insurance: Up to RM7,000 (RM3,000 for life insurance/takaful and RM4,000 for EPF/approved schemes).

- Medical & Education Insurance: Up to RM3,000.

- SOCSO/PERKESO: Up to RM350.

- Lifestyle Relief: Up to RM2,500 for the purchase of books, computers, smartphones, sports equipment, and internet subscriptions.

- Child Relief: RM2,000 per child under 18.

- Medical Expenses for Parents: Up to RM8,000.

Tax Rebate: A tax rebate of RM400 is given if your chargeable income does not exceed RM35,000.

Where to Find the Best Malaysia Income Tax Rate Calculator

When it comes to your finances, trust and accuracy are paramount.

The gold standard is the official LHDN e-Calculator, available on the MyTax portal. As the official government tool, it guarantees 100% compliance with current tax laws. It is the most authoritative source you can use.

Additionally, several reputable financial technology platforms in Malaysia offer excellent, user-friendly income tax calculators. These tools often provide a great user experience with helpful guides and are a reliable way to get a quick and clear estimate.

Real-World Example: Using a Calculator in Action

Let’s see how this works for a user named Sarah.

- Annual Salary: RM85,000

- EPF Contribution: RM9,350 (11% of salary)

- SOCSO Contribution: RM345

- Status: Single

Here’s how a calculator would process Sarah’s information:

- Aggregate Income: RM85,000

- Total Reliefs:

- Individual Relief: RM9,000

- EPF Relief: RM4,000 (capped)

- SOCSO Relief: RM345 (claimed amount)

- Lifestyle Relief (Internet & Books): RM1,200

- Total Reliefs Claimed: RM14,545

- Chargeable Income:

RM85,000 - RM14,545 = RM70,455

- Tax Calculation (based on tax brackets):

- First RM70,000: RM3,900

- Next RM455 (at 19% rate):

RM455 * 0.19 = RM86.45 - Total Estimated Tax:

RM3,900 + RM86.45 = RM3,986.45

Without a calculator, this process would be tedious and prone to error. With one, Sarah gets a clear estimate in minutes, empowering her to prepare for her e-Filing submission with confidence.

By using a Malaysia Income Tax Rate Calculator, you transform a complex obligation into a manageable financial task. It provides the clarity needed to plan effectively and ensure you are making the most of every eligible deduction.

- To see how different income bands affect your payable tax, start with an overview from the Malaysia income tax calculator.

- Tax rates only apply after deductions, so it’s useful to factor in eligible claims using the Malaysia tax relief calculator.

- Certain offsets can reduce the final amount calculated by the rates, which are clearly reflected in the Malaysia tax rebate calculator.

- For employees, understanding how rates translate into monthly deductions is easier with the monthly tax deduction calculator.

- If you want to see how tax rates apply specifically to employment income, the Malaysia salary tax calculator provides a focused breakdown.

- Self-employed individuals can better interpret the applicable tax rates by reviewing how to estimate obligations in the Malaysia taxes for self-employed guide.

- After applying the correct rates, any excess tax paid during the year can be checked using the Malaysia tax refund calculator.

Humanize 145 words