Malaysia Bonus Tax Calculator

Bonus Tax Breakdown

Bonus Tax Calculator Malaysia 2026 – Calculate Your Bonus Tax in Seconds

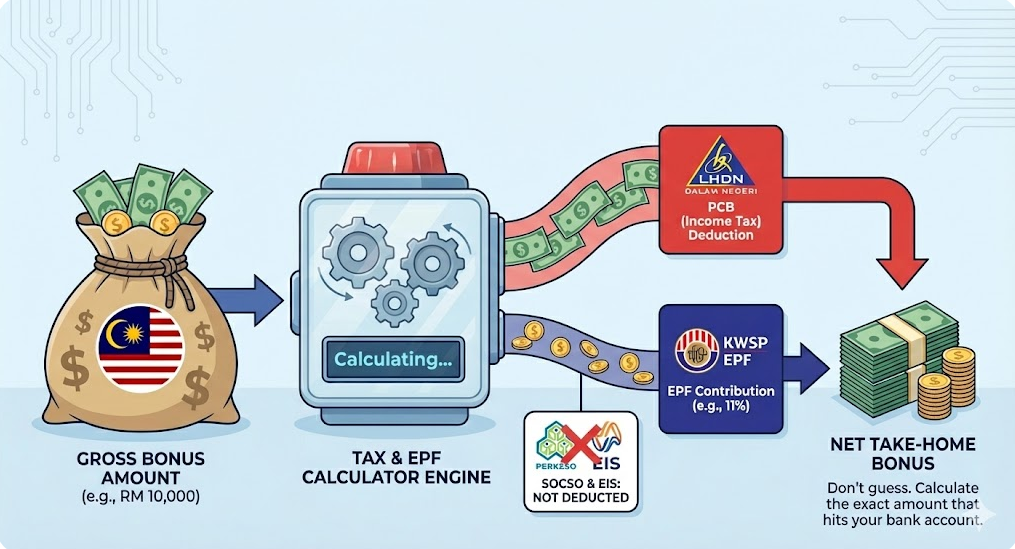

Receiving a bonus in Malaysia is exciting, but the deductions for taxes and statutory contributions can be confusing. How much of your bonus will you actually take home?

Our Malaysia Bonus Tax Calculator simplifies this process, helping you estimate your net bonus after deductions like Monthly Tax Deduction (PCB), Employees Provident Fund (EPF), Social Security Organisation (SOCSO), and Employment Insurance System (EIS).

This comprehensive guide explains how the calculator works, why it’s useful, and how you can use it to plan your finances effectively. Whether you’re an employee or an employer, this tool and guide will empower you to understand and optimize your bonus calculations for 2025.

What Is the Malaysia Bonus Tax Calculator?

The Malaysia Bonus Tax Calculator is a free, user-friendly online tool designed to estimate the net amount you’ll receive from a bonus after accounting for mandatory deductions. In Malaysia, bonuses are subject to specific tax rules and statutory contributions, which can significantly reduce the amount you take home. This calculator considers:

- Monthly Tax Deduction (PCB): Malaysia’s progressive income tax system, managed by the Inland Revenue Board of Malaysia (LHDN), deducts taxes monthly based on your income and bonus.

- Employees Provident Fund (EPF): A mandatory retirement savings scheme where both employees and employers contribute a percentage of your income.

- Social Security Organisation (SOCSO): A social security program providing benefits for work-related injuries or illnesses (note: bonuses are typically not subject to SOCSO).

- Employment Insurance System (EIS): A scheme offering income support for job loss (bonuses are generally not subject to EIS).

By entering details like your monthly salary, bonus amount, marital status, and allowable deductions, the calculator provides a clear breakdown of your net bonus, helping you plan your finances with confidence.

Why Use the Malaysia Bonus Tax Calculator?

Bonuses are a great way to boost your income, but without proper calculations, you might be surprised by the deductions. Here’s why this tool is a game-changer:

- Clarity on Deductions: Understand exactly how much is deducted for PCB and EPF, ensuring no surprises when you receive your payslip.

- Time-Saving: Manual bonus calculations are complex and prone to errors. The calculator automates the process, delivering accurate results in seconds.

- Financial Planning: Knowing your net bonus helps you budget for savings, investments, or expenses like holidays or debt repayment.

- Employer Benefits: Employers can use the tool to calculate accurate deductions for employees, ensuring compliance with Malaysian tax laws.

- Free and Accessible: Available online, the calculator is easy to use on any device, making it convenient for everyone.

How Does the Malaysia Bonus Tax Calculator Work?

The calculator follows Malaysia’s tax and contribution rules for 2025, as outlined by LHDN and other authorities. Here’s a step-by-step explanation of how it processes your bonus:

Step 1: Input Your Details

To get started, you’ll need to provide:

- Monthly Salary: Your gross monthly salary before deductions.

- Bonus Amount: The one-time bonus you’re receiving.

- Marital Status: Whether you’re single, married, or married with a non-working spouse, as this affects tax reliefs.

- Number of Children: Child reliefs reduce your taxable income.

- Other Deductions: Allowable deductions like EPF contributions (up to RM4,000 annually), life insurance premiums (up to RM3,000), or National Education Savings Scheme (SSPN) contributions (up to RM8,000).

Step 2: Calculate Total Chargeable Income

The calculator estimates your total chargeable income by combining your monthly salary and a portion of your bonus. According to LHDN guidelines, bonuses are treated as additional income and taxed progressively. The process involves:

- Dividing the bonus by 12 to estimate its monthly impact (this aligns with LHDN’s PCB calculation method).

- Adding this amount to your monthly salary.

- Subtracting EPF contributions (employee’s share, typically 11% for salaries up to RM20,000, capped at RM4,000 annually).

For example, if your monthly salary is RM5,000 and you receive a RM5,000 bonus:

- Bonus per month = RM5,000 ÷ 12 = RM416.67

- Total monthly income = RM5,000 + RM416.67 = RM5,416.67

- EPF deduction (11%) on RM5,416.67 = RM595.83 (capped if total EPF exceeds RM4,000 annually).

Step 3: Apply Tax Rates

Malaysia’s income tax is progressive, with rates for 2025 ranging from 0% to 30% based on your chargeable income. The calculator uses LHDN’s PCB schedules to determine the tax on your combined income (salary + bonus portion). For example:

- For a single employee with a chargeable income of RM5,416.67 per month (RM65,000 annually), the tax rate might be around 15.4%, with a marginal rate of 23.7% for additional income.

- The calculator computes the PCB for the combined income, then subtracts the PCB for your regular salary to isolate the bonus tax.

Step 4: Account for Statutory Contributions

- EPF: Bonuses are subject to EPF contributions (11% employee, 13% employer for salaries up to RM5,000; 12% employer for salaries above RM5,000). The calculator deducts the employee’s share.

- SOCSO and EIS: Bonuses are typically not subject to SOCSO or EIS contributions, so these are excluded from the calculation.

Step 5: Display Net Bonus

The calculator subtracts the PCB and EPF deductions from your gross bonus to show your net take-home amount. For example:

- Gross bonus: RM5,000

- EPF (11%): RM550

- PCB (estimated): RM520 (based on combined income minus regular salary PCB).

- Net bonus = RM5,000 – RM550 – RM520 = RM3,930

How to Use the Malaysia Bonus Tax Calculator: A Step-by-Step Guide

Ready to try the calculator? Follow these steps:

- Access the Tool: Visit the website hosting the Malaysia Bonus Tax Calculator (e.g., payroll.my, jeremisong.com, or fincrew.my).

- Enter Your Salary Details:

- Input your gross monthly salary (e.g., RM5,000).

- Enter your bonus amount (e.g., RM5,000).

- Select Personal Details:

- Review Statutory Contributions:

- The calculator automatically applies EPF rates (11% employee, 12–13% employer).

- SOCSO and EIS are excluded from bonus calculations.

- Calculate and Review Results: Click “Calculate” to see a breakdown of your gross bonus, deductions (PCB and EPF), and net bonus.

- Save or Print: Some calculators allow you to download or print the results for reference. Use Malaysia Salary Tax Calculator.

Benefits of Using the Malaysia Bonus Tax Calculator

This tool isn’t just about numbers—it’s about empowering you to make informed financial decisions. Here’s how it benefits you:

- Accuracy: Uses up-to-date 2025 tax rates and LHDN guidelines to ensure precise calculations.

- Transparency: Breaks down each deduction, so you understand where your money goes.

- Compliance: Helps employers ensure accurate PCB and EPF contributions, avoiding penalties from LHDN or KWSP.

- Convenience: No need for manual calculations or consulting expensive accountants.

- Planning Tool: Helps you decide how to allocate your net bonus—whether for savings, investments, or big purchases.

Malaysia’s Bonus Taxation Rules

To fully appreciate the calculator, it’s helpful to understand how bonuses are taxed in Malaysia:

Progressive Tax System

Malaysia’s income tax is progressive, meaning higher income levels are taxed at higher rates. For 2025, the tax brackets for residents are (simplified):

- RM0–RM5,000: 0%

- RM5,001–RM20,000: 1%

- RM20,001–RM35,000: 3%

- RM35,001–RM50,000: 8%

- RM50,001–RM70,000: 13%

- RM70,001–RM100,000: 21%

- And so on, up to 30% for incomes above RM2,000,000.

Bonuses increase your chargeable income, potentially pushing you into a higher tax bracket for the month they’re paid.

Monthly Tax Deduction (PCB)

PCB is Malaysia’s system for collecting income tax monthly. For bonuses, LHDN requires employers to:

- Spread the bonus over 12 months to estimate its impact on annual income.

- Calculate the PCB for the combined income (salary + bonus portion).

- Deduct the regular salary PCB to find the bonus-specific tax.

EPF Contributions

Bonuses are subject to EPF contributions, with rates as follows:

- Employee: 11% (or 7% for employees above 60).

- Employer: 13% for salaries up to RM5,000; 12% for salaries above RM5,000; 4% for employees above 60.

- Annual EPF relief is capped at RM4,000, which the calculator accounts for.

SOCSO and EIS

Bonuses are not subject to SOCSO or EIS contributions, simplifying the calculation process.

Tax Reliefs and Rebates

You can reduce your taxable income with reliefs like:

- Individual relief: RM9,000

- Spouse relief: RM4,000 (if spouse has no income)

- Child relief: RM2,000 per child

- Life insurance: Up to RM3,000

- SSPN: Up to RM8,000

- Zakat or fitrah: Rebates deducted from the final tax amount.

The calculator incorporates these reliefs when you input them, lowering your PCB.

Example: Calculating a Bonus

Let’s walk through an example to show how the calculator works:

Scenario:

- Monthly salary: RM5,000

- Bonus: RM5,000

- Marital status: Single

- No children

- No additional deductions

Calculation:

- Monthly Bonus Portion: RM5,000 ÷ 12 = RM416.67

- Total Monthly Income: RM5,000 + RM416.67 = RM5,416.67

- EPF Deduction: 11% of RM5,416.67 = RM595.83

- Chargeable Income: RM5,416.67 – RM595.83 = RM4,820.84

- PCB Calculation:

- Net Bonus:

- Gross bonus: RM5,000

- EPF: RM550 (11% of RM5,000)

- PCB: RM520

- Net bonus = RM5,000 – RM550 – RM520 = RM3,930

The calculator automates this process, displaying your net bonus as RM3,930.

You can estimate your annual tax easily with our Malaysia Income Tax Calculator before filing your return.

Tips for Maximizing Your Take-Home Bonus

- Claim All Eligible Reliefs: Ensure you include deductions like life insurance or SSPN contributions to reduce your taxable income.

- Understand Your Tax Bracket: If your bonus pushes you into a higher tax bracket, consider spreading it across multiple months (if your employer allows).

- Contribute to EPF: Higher EPF contributions reduce your taxable income, but note the RM4,000 annual relief cap.

- File Taxes Annually: Even with PCB, filing taxes can help you claim additional reliefs or rebates, potentially leading to a refund.

- Use the Calculator Regularly: Test different scenarios (e.g., varying bonus amounts) to plan your finances effectively.

Frequently Asked Questions (FAQ)

1. Is the Malaysia Bonus Tax Calculator free to use?

Yes, most online calculators, like those on payroll.my, jeremisong.com, or fincrew.my, are free and accessible on any device.

2. Are bonuses subject to SOCSO and EIS contributions?

No, bonuses are typically not subject to SOCSO or EIS contributions, only PCB and EPF. The calculator excludes these automatically.

3. How accurate is the calculator?

The calculator uses 2025 tax rates and LHDN guidelines, ensuring high accuracy. However, for official calculations, consult LHDN or a tax professional.

4. Can employers use the calculator?

Yes, employers can use it to estimate PCB and EPF deductions for employees, ensuring compliance with Malaysian regulations.

5. What if I have multiple sources of income?

The calculator focuses on employment income. For other income sources (e.g., freelance work), consult a tax professional, as they may affect your tax bracket.

6. How does marital status affect my bonus tax?

Married individuals with a non-working spouse or children can claim additional reliefs (e.g., RM4,000 for a spouse, RM2,000 per child), reducing their PCB.

7. Can I use the calculator for annual tax filing?

While designed for monthly PCB and bonus calculations, some calculators allow you to input yearly income to estimate total tax for the year.

8. What happens if my bonus pushes me into a higher tax bracket?

Your bonus is taxed at the marginal rate of your combined income. The calculator accounts for this by spreading the bonus over 12 months to estimate the tax impact.

9. Are there tax exemptions for bonuses?

Bonuses are fully taxable, but you can reduce your taxable income with reliefs like EPF contributions or life insurance premiums.

10. Where can I find the official LHDN PCB calculator?

Visit calcpcb.hasil.gov.my for LHDN’s official PCB calculator, which aligns with the schedules used by our tool.

- Understanding your bonus deduction is easier when you compare it against current slabs using the Malaysia income tax rate calculator.

- Since bonuses are taxed together with employment income, it helps to review how they interact with your regular pay via the Malaysia salary tax calculator.

- If you’re checking whether PCB already covered your bonus tax, the monthly tax deduction calculator gives a clear breakdown.

- Your final bonus tax can be reduced by eligible claims explained in the Malaysia tax relief calculator.

- Certain rebates may further lower the tax on bonuses, which you can verify using the Malaysia tax rebate calculator.

- Mandatory contributions can affect how much of your bonus is taxable, especially when you understand how EPF affects your Malaysia taxes.

- After accounting for PCB and reliefs, any excess tax paid on bonuses can be estimated with the Malaysia tax refund calculator.