Monthly Income Tax Deduction Calculator Malaysia

Estimate your monthly income tax deduction in Malaysia (YA 2025).

Estimated Monthly Tax Deduction (PCB)

RM 0.00

Annual Income

Annual EPF Relief

Total Relief

Chargeable Income

Annual Tax

Zakat Rebate

Not Included

This calculator is for estimation purposes only. Please consult LHDN or a tax professional for exact figures.

Free Malaysia Monthly Tax Deduction Calculator 2025 – Simple & Reliable

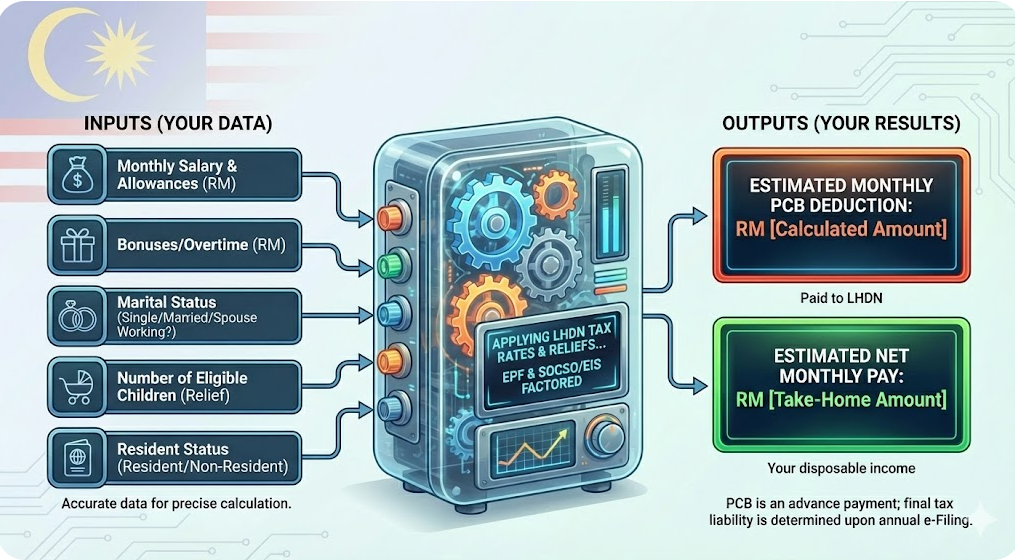

Ever looked at your payslip and wondered how the final “net salary” amount was calculated? For most employees in Malaysia, a significant part of that calculation is the Monthly Tax Deduction, or MTD. This system, known locally as Potongan Cukai Bulanan (PCB), is how the Inland Revenue Board of Malaysia (LHDN) collects income tax in manageable monthly installments.

This guide is for any employee, HR professional, or individual in Malaysia who wants to understand their tax obligations and accurately forecast their take-home pay. We’ll explore what PCB is, how it’s calculated, and how you can use a reliable Monthly Income Tax Deduction Calculator Malaysia to gain financial clarity.

What is Monthly Tax Deduction (PCB) and Why is it Necessary?

Monthly Tax Deduction (PCB) is a mechanism requiring employers to deduct income tax directly from an employee’s monthly salary. Think of it as an advance payment on your annual income tax. Instead of facing a large tax bill at the end of the year, your liability is spread out over 12 months, making it easier to manage your finances.

This system ensures a steady revenue stream for the government and prevents the burden of a single, substantial tax payment for individuals. If the total PCB deducted throughout the year is more than your final tax liability (calculated when you file your annual return), you are entitled to a tax refund from LHDN.

How to Calculate Your Monthly Tax Deduction (PCB)

Calculating your PCB isn’t as simple as applying a flat percentage to your salary. The calculation is a multi-step process that estimates your annual tax liability and then divides it by twelve. A reliable tool like our embeddable Monthly Income Tax Deduction Calculator Malaysia automates this, but understanding the steps is crucial.

Here’s a breakdown of how the calculation works:

- Determine Your Annual Taxable Income: First, your total annual income is calculated. This includes your monthly salary multiplied by 12, plus any additional income like bonuses, commissions, or overtime.

- Formula: (Monthly Salary x 12) + Annual Bonus + Other Additional Income = Gross Annual Income

- Subtract Your Tax Reliefs and Deductions: This is the most critical step for reducing your tax. Your Gross Annual Income is reduced by subtracting all eligible tax reliefs and statutory deductions. The result is your Chargeable Income.

- Formula: Gross Annual Income – Total Tax Reliefs – Total Deductions = Chargeable Income

- Apply Malaysia’s Progressive Tax Rates: The LHDN uses a progressive tax system, where different portions of your chargeable income are taxed at increasing rates. For the 2025 Year of Assessment, these rates range from 0% for the lowest income band to 30% for the highest. The calculator applies these brackets to determine your total annual tax.

- Calculate the Final Monthly PCB: The total annual tax is divided by 12 to get a monthly figure. Any monthly Zakat payments are then subtracted from this amount to arrive at your final PCB for the month.

- Formula: (Annual Tax / 12) – Monthly Zakat = Final PCB

Try: Malaysia Rental Income Tax Calculator !

Key Factors That Influence Your PCB Calculation for 2025

Several variables can significantly impact your monthly tax deduction. Understanding these allows you to maximize your take-home pay legally.

- Marital Status: Your status as single, married with a working spouse, or married with a non-working spouse affects the reliefs you can claim.

- Number of Children: You can claim a tax relief of RM2,000 for each unmarried child under the age of 18.

- EPF Contributions (KWSP): Your mandatory contributions to the Employees Provident Fund are a primary tax relief. This is capped at RM4,000 per year.

- SOCSO (PERKESO) and EIS: Your contributions to the Social Security Organisation and Employment Insurance System are also deductible, up to a combined annual limit of RM350.

- Personal Relief: Every resident individual automatically gets a personal relief of RM9,000.

- Spouse Relief: If your spouse has no income or elects for a joint assessment, you can claim a relief of RM4,000.

- Zakat Payments: For Muslim employees, Zakat acts as a direct rebate on your tax. The amount you pay is deducted from your monthly tax liability.

When comparing different salary options, the Malaysia Income Tax Calculator helps you see how each amount affects your tax.

How to Use the Monthly Income Tax Deduction Calculator Malaysia

Using an online calculator is the easiest way to get an accurate estimate. Our embeddable calculator is designed for this purpose.

- Enter Your Monthly Salary: Input your gross monthly salary before any deductions.

- Add Any Bonus: If you have received a bonus or other additional income, enter the amount.

- Select Your Status: Choose your current marital status and enter the number of eligible children.

- Confirm Your EPF Rate: Select your employee EPF contribution rate (typically 11%).

- Enter Zakat: If applicable, input your monthly Zakat payment.

- Click Calculate: The tool will instantly display your estimated PCB, a full breakdown of your deductions (EPF, SOCSO, EIS), and your final net take-home pay.

Frequently Asked Questions (FAQ) About PCB

1. Is my Monthly Tax Deduction (PCB) the final tax I have to pay?

No, PCB is an estimate. You are still required to file an annual tax return (Form BE/B) via the e-Filing system. Your final tax liability will be confirmed at that point.

2. What happens if I overpay my PCB?

If your total PCB for the year exceeds your final tax amount, LHDN will issue you a tax refund after you have filed your annual return.

3. How does a bonus affect my PCB?

A bonus increases your gross annual income, which can push you into a higher tax bracket for that month, resulting in a larger PCB deduction. The calculator accounts for this to give you an accurate estimate.

4. Do I need to file taxes if my employer is already deducting PCB?

Yes. Filing an annual tax return is mandatory for all eligible taxpayers. It is your opportunity to claim all reliefs you are entitled to and ensure your tax is calculated correctly.

By using a Monthly Income Tax Deduction Calculator Malaysia, you empower yourself with the knowledge to understand your earnings, plan your finances effectively, and ensure you are meeting your tax obligations correctly.